With the spread of digital banking, and excessive use of smartphones customers can make transactions anytime anywhere. Traditional payment service providers are unable to provide users with the benefit of performing financial activities during holidays and weekends. Furthermore, suppliers face delays in the amount credited, additional fees for cheque transfers, and other complexities.

Europe has been making efforts to streamline online banking and provide both businesses as well as customers with digital financial services. Firstly by introducing the Single Euro Payment Area (SEPA) in 2008 and secondly after making SEPA instant credit transfer the new normal in 2017 for the payment industry. This article further discusses how SCT Inst, a pan-European network for instant bank transfers, meets the expectations of both customers and businesses.

Reasons for the Creation of the SCT Instant Transfer Scheme

In the evolving financial landscape and advancements brought about by digitization, consumers demand faster, better, and more secure banking services. After the accelerating emergence of credit/debit card payments, it did not take long for customers to adopt this method. Furthermore, with a user-friendly 3DS2 authentication protocol in place, a general perception of instant business operations also increases.

Certain know your transaction limitations hinder companies’ development. Moreover, transactions taking place via bills or invoices take a long time to credit. B2B payments are facing several delays in withdrawals, crediting, and re-transferring due to incompatible financial systems.

In order to overcome complexities and shortcomings in banking systems, European countries including Norway, the UK, and Germany came up with an initiative to create their own payment channel, named “Single Euro Payments Area (SEPA)”. The only limitation in creating a designated transaction system was that the national money movement will stay within the borders. Ultimately, this will create a fragmented European SCT instant transfer landscape.

Considering European mobility, another payment system came into existence. With SEPA instant credit transfer, businesses can make transactions with the same convenience, security, and ease across SEPA and their home countries.

Countries Included in SCT Inst

Currently, there are twelve countries falling under SEPA that hold a substantial majority of reachable accounts for SEPA instant credit transfers. However, the number of regions is predicted to grow in the upcoming years. At present time, the countries include:

- Austria

- Finland

- France

- Germany

- Estonia

- Italy

- Netherlands

- Belgium

- Lithuania

- Spain

- Portugal

- Latvia

Impacts of SCT Inst Credit Transfer Scheme on the Payment Landscape

Digitization of the payment industry is one of the most significant advancements. The launch of the European SEPA instant credit transfer scheme is another progressive step towards real-time cross-border transactions across a huge number of connected banks. Businesses can now avail “just-in-time” payment features while decreasing transfer delays both in terms of regional and international transfers. Furthermore, SEPA instant credit transfer banks enable companies to save additional financial charges and streamline reconciliation tactics.

After realizing the potential of SEPA instant credit transfer, the Network Services Director at SIA “Andrea Galeazzi” emphasized payment providers implement this tech-driven financial scheme from the beginning. In an interview, he further said:

“The payment scheme’s adoption can bring new business opportunities in almost all kinds of payments. From P2P transactions to the P2B/B2B environment for payments in e-commerce, insurance, automotive, supply chain, oil, or gas supply, refunding, etc.”

Factors Making SCT SEPA Credit Transfer Favorable for B2B Transactions

Since 2017, SEPA credit transfer instant transactions are made in 12 European countries and the aim is to cover 36 territories within a short time span. Payment Service Providers (PEPs) across the EU member countries are encouraged to make this scheme a part of their financial services. The SEPA instant credit transfer system is opening doors for businesses to improve their transactional patterns. Furthermore, instant credit and debit enable companies to avoid unexpected payment delays.

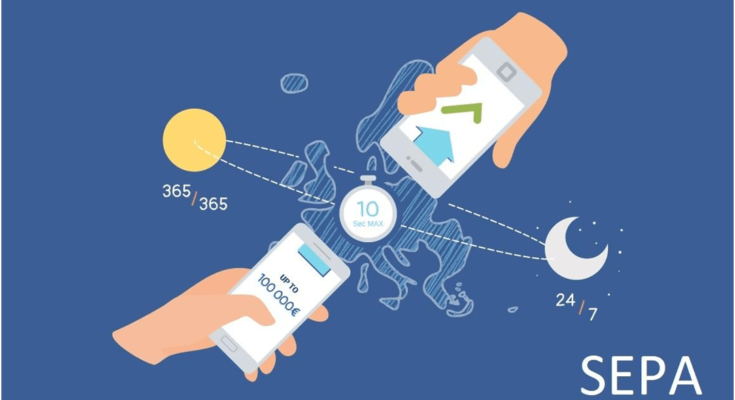

SEPA instant credit transfer scheme is benefiting businesses in numerous ways by providing real-time money movement. It helps both payment service providers and end-users to make immediate payments without using invoices or bills.

Further benefits of the SCT SEPA credit transfer scheme include:

- With SEPA instant credit transfer businesses can complete transactions within five seconds.

- It streamlines businesses’ cash flows by facilitating payments of a maximum €100,000.

- Businesses can initiate the SEPA credit transfer scheme without worrying about the transaction methods such as credit/debit cards, settlements, and interbank clearance.

- SEPA instant credit transfer is accessible for companies and customers 24/7 as it involves digital banking and payment infrastructures.

Key Takeaways

Factors such as speed, high-value transactions, security, and real-time payments are playing a vital role in accelerating the adoption of the SEPA instant credit transfer scheme. However, there are some challenges such as territorial restrictions, incompatible financial systems, and others for businesses. Therefore, banks and KYT solution provider across Europe are implementing SEPA instant credit transfer schemes to facilitate companies with immediate transactions. Hence, the implementation of SCT Inst will enable businesses and financial systems to reap long-term benefits.